nebraska inheritance tax worksheet form 500

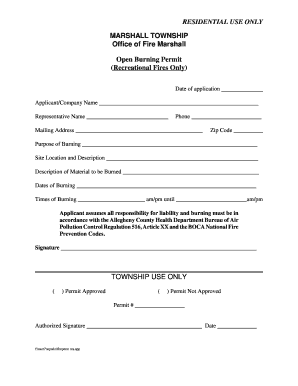

This page provides access to the forms currently available to the public and attorneys through the Administrative Office of the Courts. Nebraska inheritance tax worksheet snowiworksheetco.

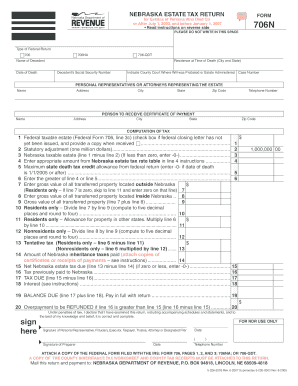

Form 706n Fillable Nebraska Estate Tax Return For Estates Of Persons Who Died On Or After July 1 2003 And Before January 1 2007 6 2007

201 rows Master Forms List.

. Sign in to the editor with your credentials or click Create free account to evaluate the tools functionality. Nebraska State Bar Association 635 S. Learn more 2004 Instructions For Form.

Wait until Nebraska Inheritance Tax Worksheet is ready. Get the form you require in the library of legal forms. Form 500 Free eBook Download Nebraska Inheritance Tax Form 500 Download or Read Online eBook nebraska inheritance tax form 500 in PDF Format From The Best Book Database The.

NF96-236 Nebraska Inheritance and Estate Taxes. Settling an estate can be complicated and completion of the Inheritance tax form and Probate Inventory Worksheet can be difficult. These forms are from.

Stick to these simple guidelines to get Nebraska Probate Form 500 Inheritance Tax prepared for sending. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other. Nebraska Inheritance Tax Form 500 Free eBook Download Nebraska Inheritance Tax Form 500 Download or Read Online eBook nebraska inheritance tax form 500 in PDF Format From The.

How to Edit and fill out Nebraska Inheritance Tax Worksheet Online. By JD Aiken 1996 The Nebraska inheritance tax is imposed on all property inherited. Suite 200 Lincoln NE.

In some estates this may require appraisals. 3-2019 Nebraska Historic Tax Credit NHTC Worksheet. As well as how to collect life insurance pay on death accounts and.

Info about Nebraska probate courts Nebraska estate taxes Nebraska death tax. Because of the complexity of estates this Self-Help. FORM 3800N Worksheet NHTC Name as Shown on Form 3800N Social Security Number or Nebraska ID Number 8-755-2016 Rev.

To start with look for the Get Form button and tap it. Open the template in our online. Property at the date of death.

An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to. Nebraska Inheritance Law. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098.

Add the nebraska inheritance tax worksheet form for editing. Letter demand stolen return form property sample appreciation inheritance retirement company nebraska tax pdffiller president.

Nebraska Probate Form 500 Inheritance Tax Fill And Sign Printable Template Online

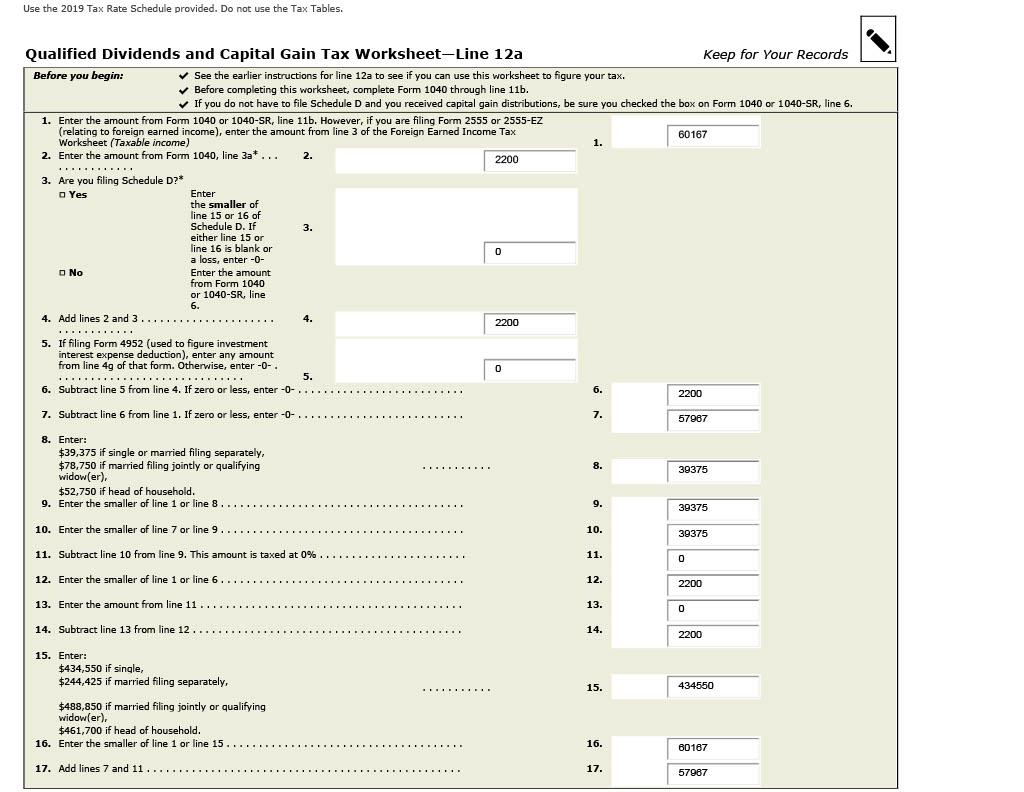

Solved Please Help Me With This 2019 Tax Return All Chegg Com

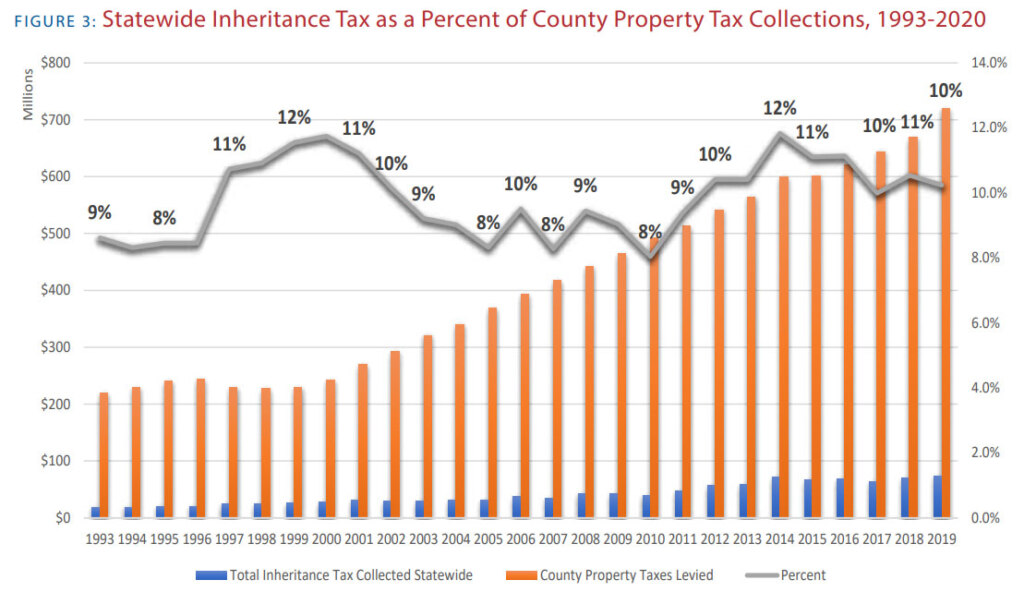

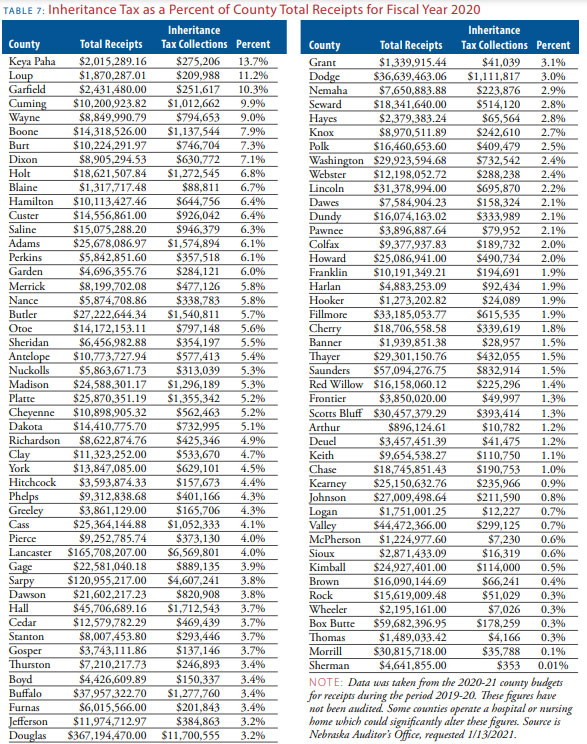

Death And Taxes Nebraska S Inheritance Tax

Death And Taxes Nebraska S Inheritance Tax

Nebraska Inheritance Tax Worksheet Form Fill Out Sign Online Dochub

Nebraska Inheritance Tax Worksheet Form Fill Out Sign Online Dochub

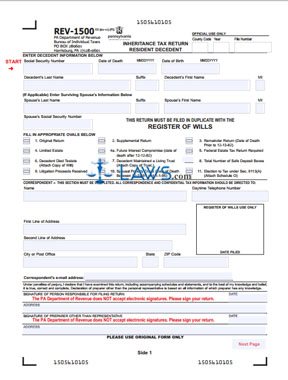

Free Form Rev 1500 Inheritance Tax Return Resident Free Legal Forms Laws Com

Nebraska Inheritance Tax A Brief Overview And Tax Planning Opportunities Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

Does Nebraska Have An Inheritance Tax Hightower Reff Law

The Nuts And Bolts Of Nebraska S Inheritance Tax Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

April 2018 Narfe Magazine By Narfe Issuu

Fillable Online Free Download Nebraska Inheritance Tax Form 500 Free Download Nebraska Inheritance Tax Form 500 Fax Email Print Pdffiller

I 1040 Pdf Irs Tax Forms Earned Income Tax Credit

Nebraska Inheritance Tax Worksheet Form 500 Fill Out Sign Online Dochub

Fillable Online Revenue Ne Nebraska Estate Tax Return Form 706n Fax Email Print Pdffiller